Deliver a Unified Customer Experience with Visa Flexible Credential

Debit or credit? No problem. In the near future, flex between funding sources from one credential.

For 70 years, cards have been at the heart of Visa’s product offering. Traditionally, the world has viewed cards through a singular lens: a debit card has always just been a debit card, a credit card has always just been a credit card, and a rewards card has always just been a rewards card.

But in today’s digital world, Visa aims to transcend beyond static perceptions of credentials, offering issuers the option to provide dynamic and personalized experiences that meet consumer needs at every touchpoint. Because nothing else in our digital lives remains static – so why should our cards?

Visa Flexible Credential offer a powerful solution that enables consumers to seamlessly switch between debit, credit, rewards points, installments, and multi-currency options, all under the issuance of a single bank and a single card, helping to usher in a new, seamless era of payments and at-your-fingertips convenience.

Next-gen solutions speak to next-gen consumers.

Consumers are increasingly seeking more flexibility and searching for innovative solutions, big or small, that can adapt to their preferences and make their lives easier.

The Visa 2024 Global Digital Shopping Index found that 3 in 4 consumers¹, including those in the UAE and Saudi Arabia, want the ability to use their preferred payment method when transacting. In parallel, flexible payment options such as BNPL have experienced significant growth worldwide and are expected to continue building momentum.

It is evident that consumers today value having a choice in how they pay and get paid. Visa Flex Credential aim to put that power and control in their hands through varied offerings:

- Dynamic options: Bundles payment methods into one card, including debit, credit, multi-currency, and installments, as well as offering instant access to short-term loans.

- Convenience: Eliminates the burden of carrying multiple cards every day.

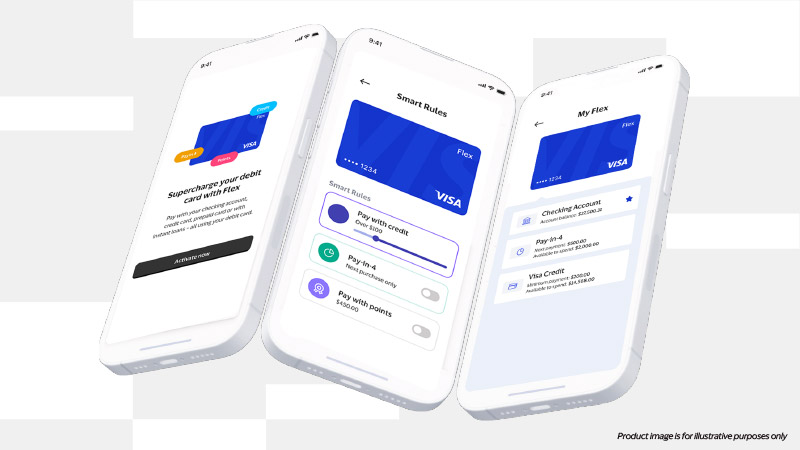

- Personalization: Allows consumers to pre-set their own parameters using the issuer’s mobile application to seamlessly pay with debit, credit, “pay-in-four” installments, reward points, or even in another currency, based on the transaction type or size.

- Existing infrastructure: Ensures broad acceptance with access to Visa's extensive network of endpoints

Essentially, Visa Flexible Credential enhances the consumer experience by providing single-card access to multiple funding sources, while also enabling them to set customizable transaction rules, such as charging amounts under $100 to a current account, while charging transactions of more than $100 to credit.

With these dynamic options, Visa Flexible Credential empowers consumers to choose what’s best for them – when and where they want to.

Cross-selling, revenue potential, and easy integration for issuers.

For issuers, Visa Flexible Credential opens the door to bolster existing relationships with consumers whilst also drawing in additional users, helping to consolidate consumer spending within a single bank and enhance new-to-bank conversion rates.

Furthermore, the Visa Flexible Credential solution drives easier cross-selling of new products under a single credential – for instance, a debit cardholder can easily sign up for a credit card, and vice versa – contributing to vital growth areas such as loyalty, top-of-wallet positioning, and consumer stickiness.

Issuers can also increase payment volumes, drive IRF revenue, and optimize costs across acquisition, product management, development, printing, and delivery, all while benefiting from a seamless integration process, thanks to a plug-and-play approach and Visa’s APIs that enable faster go-to-market times.

Looking ahead, the future of credentials will be defined by their ability to address and adapt to evolving consumer needs. By bundling multiple funding sources into one dynamic card, Visa’s single-issuer, single-credential solution enriches and streamlines experiences for modern-day consumers, offering them the convenience they desire.

_____________________________________________________________________________________________________________________________________________________________________

The future of payments is here. Are you equipped to lead the way?

Discover the power of Visa Flex Credential: Visa Flexible Credential for a unified customer experience | Visa

_____________________________________________________________________________________________________________________________________________________________________

¹The 2024 Global Digital Shopping Index: Global Edition (PDF) (visaacceptance.com)