How embracing a multilateral model gives banks a competitive edge

For cross-border payments, multilateral models can unlock lower costs, enable quicker transaction times, and foster greater transparency.

In the world of international banking, cross-border payments have long been plagued by slow transaction times, high costs, and a lack of transparency. The traditional bilateral model of correspondent banking relationships is arguably outdated and inefficient, causing headaches for financial institutions and their customers around the world. However, a fresh wave of fintech innovation is set to shake up the space as multilateral payment platform models gain popularity.

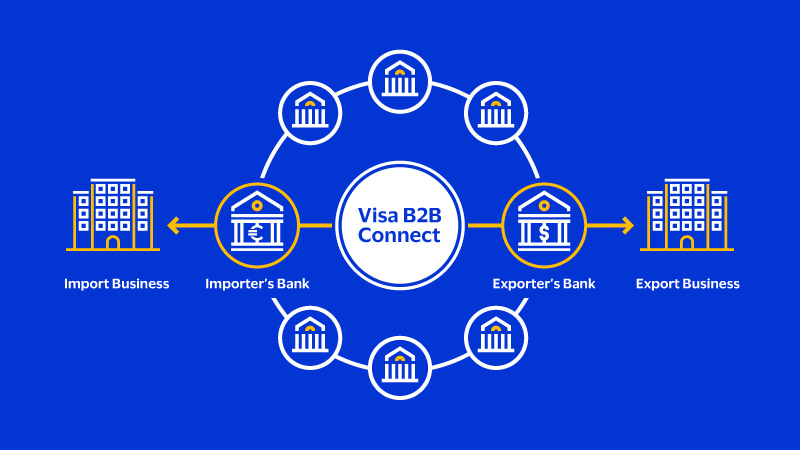

One such solution is Visa B2B Connect, an innovative non-card multilateral platform that offers a persuasive alternative cross-border payment solution that addresses the unpredictability that was the unfortunate hallmark of the traditional correspondent model.

In this article, we take a closer look at the challenges of the old bilateral model of correspondent banking relationships and explore the need for a multilateral model. We'll also dive into the features and benefits of the Visa B2B Connect solution, and highlight the benefits it delivers for banks, financial services professionals and their business/commercial customers.

Challenges of the old bilateral model

The old bilateral model of correspondent banking relationships worked by relying on intermediaries to facilitate cross-border payments. However, this system was fraught with challenges, not least being high transaction costs, slow transaction times, and a lack of transparency. The complex web of intermediaries also made it difficult to identify and address issues such as fraud and errors, while being an inconsistent model for the payers and receivers due to the varying operational and reconciliation processes followed by the intermediaries.

The need for a multilateral cross-border payments model

A multilateral model for cross-border payments can help address many of the challenges that arrive with the traditional bilateral model. By using a shared platform, financial institutions can communicate directly with each other, thus reducing the need for intermediaries whilst streamlining the payment process. The end result? Faster transaction times, lower costs, and greater transparency.

Examples of successful multilateral payment platforms in the financial services industry include ACH and RTGS platforms operated by various regulators around the world. It also includes the Visa B2B Connect platform, a multilateral platform model for cross-border payments that uses distributed ledger technology (DLTT) and tokenization to facilitate secure and efficient transactions.

How Visa B2B Connect benefits banks and financial services professionals

By allowing financial institutions to communicate directly with each other and eliminating the need for intermediaries, Visa B2B Connect offers reduced costs and faster transaction times, enabling institutions to process a higher volume of payments more efficiently.

Real-time tracking of payments within the network and automated reconciliation also make the payment process much faster and transparent. It also allows for better monitoring and identification of critical issues such as fraud and errors.

Representing a major step forward for the world of cross-border payments, Visa B2B Connect can help financial institutions stay competitive in an increasingly digital and globalized world.

If you're interested in learning more about B2B Connect and exploring how it can benefit your business, click here to discover more.