The Future of Online Payments Is Here

Visa is making every online transaction smarter, safer, and simpler for both businesses and consumers. Through secure payment innovations, Visa helps reduce fraud, increase revenue, and deliver seamless digital experiences — empowering businesses to grow while giving consumers greater confidence and convenience online.

Tokenization and Why It Matters

Tokens replace sensitive card numbers with secure, dynamic credentials — making payment details unreadable to fraudsters. They reduce fraud, build trust, and increase approval rates while ensuring a faster, password-free checkout experience. Since pioneering the technology in 2014, Visa is now making tokenization the standard for eligible online transactions worldwide.

- In 2023 alone, Visa Tokens helped generate $40B in additional eCommerce revenue for businesses worldwide.

- Businesses saved more than $600M in fraud losses thanks to tokenization.

- Today, 50% of Visa’s global eCommerce transactions are tokenized — and we’ve already issued nearly 15B tokens worldwide.

Biometrics: Your Identity, Your Security

Passwords are quickly becoming a thing of the past. With Visa’s biometric authentication, shoppers can check out with a simple fingerprint or face scan — bringing more convenience and stronger security to every transaction.

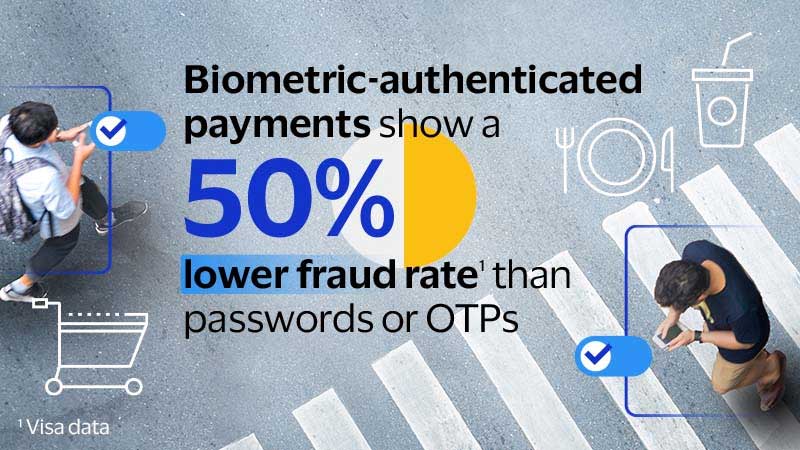

- By using unique physical identifiers, biometrics significantly lower fraud rates — up to 50% compared to traditional methods.

- Visa Payment Passkeys: A new solution enabling biometric identity verification, rolling out globally in 2025.